Do I have to file for Federal Student Aid every year?

When are the deadlines?

In order to be considered for Federal Student Aid and certain scholarships and grants, you must apply every year! FAFSA applications for the upcoming 2025-2026 year are available now.

What happens if I fail to complete the application process?

Failure to complete the application process in a timely manner may result in loss of aid and an immediate demand for payment of tuition and other debts.

It has been a while since I have filed my application but I still have not received my FAFSA Submission Summary. What can I do?

Contact the Federal Student Aid Information Center at 1-800-4FEDAID to find out the status of your file.

Do I need to send a copy of my FAFSA Submission Summary to the Financial Aid Office?

No. Provided that you listed Hofstra (code: 002732) as one of the schools on the FAFSA, we will receive the information electronically. Therefore, you do not need to send your FAFSA Submission Summary to our office.

If Hofstra is not listed on my FAFSA Submission Summary, how can I add the school code?

If you did not list Hofstra on your FAFSA, you may log onto studentaid.gov to add our school code (002732).

My parents are separated/divorced or I don't live with them, how do I file the FAFSA?

Click here for information from the federal government on how to file your FAFSA.

What is the website to file and make corrections to the FAFSA?

www.studentaid.gov/ For step by step assistance, call 1-800-4-FED-AID.

What is the website to request a FSA ID to file the FAFSA?

www.studentaid.gov/fsaid

Who must have a FSA ID to file the FAFSA?

The student and one parent (one parent FSA ID is required if the student is dependent).

My stepparent is not responsible for supporting me, why do I have to report his/her information on the FAFSA?

If the parent you reside with is remarried, you must report your stepparent's information on the FAFSA. This is required by federal financial aid regulations.

How do I complete the FAFSA if I have not filed my tax returns yet?

We recommend that you complete the FAFSA using estimated information. You can make corrections to the FAFSA once the tax forms have been filed.

What is the difference between the child support reported in the "Additional Financial Information" section of the FAFSA worksheet and the "Untaxed Income" section?

The amount reported in the "Additional Financial Information" section is child support paid into the household where the student lives. The amount reported in the "Untaxed Income" section is child support paid out by the parent with whom the student lives.

Does child support received for a dependent student get reported in the student "Untaxed Income" section of the FAFSA worksheet or the parent section?

Child support for all dependent children in the household including the student is reported in the parent section. (The student section of the worksheet is only for independent students with children of their own.)

How are 529 plans reported on the FAFSA?

529 plans are reported under the "owner" as an investment not the beneficiary. If the parent is the owner, it is reported under the parent. If the parent has more than one 529 plan for various members of the family including siblings of the student, all must be reported under the parent. If another person (grandparent, etc.) is the owner, only report the actual amount of the fund disbursed from the account for the applicable tax year to the student under the untaxed income section on the FAFSA; do not report the value of the account in the asset investment section.

Are the parent(s) included in the number in the household?

Yes and don't forget to include the student(s) who will be attending college next fall.

Do we have to report the net worth of our home in the investment question?

You do not report your primary residence. Only report other real estate and investments like rental properties or a vacation home, etc. If a portion of your primary residence is rented though, you must report the portion that is rented.

How do I find out the Federal college codes of the schools I want to apply to?

There is a search online when you are completing the FAFSA, ask the colleges directly or call the FAFSA toll free number at 1-800-4-FED-AID. Hofstra's Federal school code is 002732.

Effective for the 2024-2025 FAFSA, you will be able to add up to 20 colleges.

I can only send the FAFSA to 10 colleges. What if I need to send the FAFSA to more?

You can change the codes by going back into the FAFSA online or call 1-800-4-FED-AID and do it over the phone.

I am interested in living on campus but not sure. Which answer should I indicate on the FAFSA?

If you are interested in living on campus, you should indicate on campus. If you need to change the status later to with parent or off campus, you must inform Hofstra's Student Financial Services Office directly.

What is the difference between "with parent" and "off campus" housing status?

With parent means the student will be commuting from their parent(s) or other relative's home. Off campus means the student will be commuting from his/her own home or apartment.

There is no place to indicate special circumstances such as loss of income on the FAFSA. Can I request a special circumstances assessment?

Yes. Most colleges have a special form for this. Once your FAFSA has been processed, please contact the office of Student Financial Services if you have had any significant changes to your income since completing the FAFSA. Your counselor will provide a preliminary assessment and advise you of the supporting documentation required. Call 516-463-8000.

How long will it take before I receive my financial aid award package based on the FAFSA from Hofstra?

As long as you have been accepted for Admission at Hofstra, approximately four weeks from the time you file the FAFSA. The first mailing of financial aid notifications will be sent out to accepted students mid to late January.

How do I file for TAP?

If you are a New York State resident, there will be a link to apply for TAP at the end of the FAFSA to file online. If you miss the link, wait approximately five days then go directly to the TAP web site to apply at www.hesc.ny.gov. Hofstra's TAP code is 0300. For step by step assistance, call 1-888-NYS-HESC (1-888-697-4372).

What is the deadline for filing my TAP application?

To receive any state-sponsored award or scholarship, students must submit an application to HESC by June 30 of the academic year for which assistance is sought.

Will I be able to get TAP if I attend college in another state?

No. TAP is for NYS residents attending a college located in New York state full-time.

The FAFSA indicates I must be a U.S. citizen or eligible non-citizen to file the FAFSA and receive federal financial aid- what if I am an undocumented "dreamer"? Am I eligible for federal financial aid?

No, undocumented students are not eligible for federal financial aid. For more information, please visit https://studentaid.ed.gov/sites/default/files/financial-aid-and-undocumented-students.pdf

Will an Incomplete FAFSA Be Deleted After 45 Days Of Inactivity?

Yes. According to the 2024–25 FAFSA Form Preview Presentation (slides 50 to 52), an incomplete FAFSA will be deleted after 45 days of inactivity. NASFAA has confirmed with the U.S. Department of Education (ED) that an incomplete FAFSA is one that is started, not submitted, and abandoned (no activity in 45 days).

A FAFSA cannot be considered submitted until all required contributors have completed, signed, and submitted their respective sections. When a student or other contributor completes their section of the online FAFSA, they will invite the other contributor(s) to log in and complete their own sections of the FAFSA. The other contributor(s) will then receive the invitation and reminder emails every 7 days throughout that 45-day period until the FAFSA is submitted. If a contributor does not complete their section within that 45-day window, and there is no other activity, the FAFSA will be deleted and all contributors (including the student) will have to start over.

Example: The dependent student has two additional required contributors. The student starts and completes their section. One parent starts and completes their section, and identifies another parent (stepparent) who is required to complete the FAFSA. The student and parent 1 complete their sections, but the stepparent doesn’t. The FAFSA will be deleted after 45 days of inactivity from any of those contributors. So, if parent 1 was the last to enter and save the FAFSA, and no activity happens after 45 days from then, it will be deleted. Everyone will have to start over.

Logging Activity: It's not as simple as logging into StudentAid.gov. The student or contributor must go beyond logging into the StudentAid.gov dashboard and accessing the FAFSA itself. The student or contributor has to log into StudentAid.gov and enter the FAFSA by clicking on the FAFSA link. Then, they must go far enough to save the FAFSA, meaning they must at least navigate to any page that has the save option and click "Save" on that page:

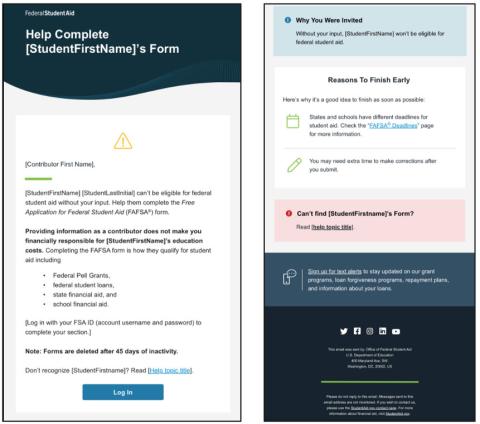

FAFSA Contributor Notification: The FAFSA contributor is alerted in several places that the FAFSA will be deleted after 45 days of inactivity. For example, this is an image of the slide that displays a StudentAid.gov view of a parent opening the FAFSA invitation from their email:

Contributors

Students will be prompted to supply contributor information based on how student answers questions. Be sure to follow all prompts. The contributors will be based on tax filing status.

Is there a deadline to register and be eligible for Financial Aid?

If you are planning to attend Hofstra University, are eligible to receive financial aid and have satisfied all of your financial aid requirements, your aid will be disbursed (if applicable) approximately 10 days prior to the start of classes for each semester. As of census date (the day after the absolute last day to register), the Office of Financial Aid will verify your enrollment. Aid will be adjusted to your enrollment as of the date of census. After this date, no adjustments or increases will be made to your financial aid and all financial aid payments will be final. As of census, students will be financially responsible for any additional charges as a result of updates to registration.

To review registration deadlines, please visit hofstra.edu/deadlines

What does this mean for you?

At census, your enrollment will be locked and your financial aid will be adjusted accordingly. If your financial aid award was originally disbursed on full-time status and you are no longer enrolled full-time at census, your financial aid may be decreased to match your enrollment. This adjustment could result in a balance being owed to the University. If your award was originally disbursed based on less than full-time status and you are now enrolled full-time, your financial aid will be adjusted to match enrollment.

IMPORTANT: If you change your enrollment after the census date, with the exception of a complete withdrawal of all classes, your financial aid will not be revised and you will be responsible for any additional charges assessed as a result of updates.

Enrollment status definitions are as follows:

Undergraduate Students:

| Credit Hours | Enrollment Status |

| 12 or More | Full time |

| 9 – 11.99 | Three-quarter time |

| 6 – 8.99 | Half time |

| 1 – 5.99 | Less than half time |

Graduate Students:

| Credit Hours | Enrollment Status |

| 9 or more | Full time |

| 6 – 8.99 | Three-quarter time |

| 4.5 – 5.99 | Half time |

| 4.4 or less | Less than half time |

When will my aid appear on my account/disburse?

Your student aid usually disburses to your account on or about 10 days prior to the start of each term. For the fall semester, your grants and scholarships will pay on or after September 1. TAP will disburse to your account approximately 7-8 weeks into the term after the absolute last day to register. Please note: Disbursement may not occur if you have not completed all the requirements and/or submitted all the required documentation.

Students have the right to cancel all or part of the loan or disbursement prior to or after the funds have been disbursed to the University. Prior to the disbursement of the loan students should contact the Hofstra Student Financial Services Suite and request that the loan be canceled or reduced. After the loan has been disbursed to the University, students need to contact the Office of Student Financial Services and request that all or a portion of the loan funds be returned to their lender. You can contact the Office of Student Financial Services via E-mail or visit them in person in Memorial Hall on the second floor.

Why does my award change each year?

At Hofstra, eligibility for financial aid is based on federal and institutional estimates of your family's ability to contribute to the cost of education. A typical award includes grants, loans and federal work-study.

Keep in mind that your award is likely to change each year for one or more of the following reasons:

- The cost of education goes up

- Your family's income changes

- The number of children in college changes

What are the Satisfactory Academic Progress requirements for my federal student aid?

Click here for information

What should I do if I decide to attend another institution?

You must officially drop your HOFSTRA classes to avoid being charged for classes that you do not attend.

What if my educational or career plans change, or something happens after I'm out of school and working?

A change in career goals, the loss of a job, or other unexpected changes in your situation could make repaying your loan more difficult than you expected. In some cases, and at the lender's option, you may be permitted to temporarily stop making your payments, or your lender may accept smaller payments than scheduled. This is called a forbearance. In addition, for some loans, you may defer repayments temporarily, which may help. The promissory note for each loan you borrow outlines the specific terms under which you may be granted a deferment. Contact your lender if you think you may need to make arrangements.

How can a drug related offense impact my eligibility for federal student aid?

Get details from studentaid.gov

What are some of the common mistakes people make while filing for financial aid?

Some of the most common are:

- Not filing early enough

- Not reading the instructions

- Not fully completing the applications

- Not using the correct social security number

- Not signing it properly either electronically or on paper

What determines whether or not I will receive financial aid?

The Primary factor is financial need. Financial Need is based on determining the educational cost (tuition & fees, room & board, books & supplies and a personal allowance) minus the Student Aid Index (SAI), (based on federal and institutional formulas). The result of these two factors determine the need for federal financial assistance.

Will a bad grade, dropping or withdrawing from classes affect my eligibility for aid?

Yes, it might. Our office is required to monitor a student's grade performance, check completion of hours and make sure a student stays within a time frame for seeking a degree. A student would want to make themselves familiar with our academic progress policies and seek counseling immediately from our office if the student has an academic progress concern.

How do I know my application was processed?

How can I verify that HOFSTRA will receive the results?

About four weeks after sending in the FAFSA, you should receive a Student Aid Report (SAR). This is verification that you filed the FAFSA and that it has been processed. Check to make sure HOFSTRA is one of the schools listed in Step Five. Questions about FAFSA processing can be directed to the Federal Student Aid Information Center at 1-800-4FEDAID.

Why was my FAFSA selected for verification?

Many student files are selected by the Federal Processor in the process of applying for aid. Some files are randomly selected while others are selected because of appearing to be error prone. If the student's file is selected, requested documentation should be submitted to the Office of Student Financial Services at Hofstra immediately because of specified deadline date requirements.

I think I am independent for financial aid. What are the requirements?

For Federal Student Aid

You must meet at least one of the following criteria to be declared an independent student for the purposes of the FAFSA:

- Be 24 years of age or older by December 31 of the award year;

- Be an orphan (both parents deceased), ward of the court, or was a ward of the court until the age of 18;

- Be a veteran of the Armed Forces of the United States;

- Be a graduate or professional student;

- Be a married individual;

- Have legal dependents other than a spouse;

- Be a declared emancipated minor;

- Be or was under legal guardianship;

- Was determined by your high school district homeless liaison, a director of an emergency shelter or a director of a runaway or homeless youth basic center to be an unaccompanied homeless youth

If you do not meet any of these criteria, but still think you might be independent, you can complete the request for Dependency Status Appeal form. In order to be considered an independent student, you must meet the following criteria: An extreme situation exists in your family that prevents you from obtaining your parents' financial information, such as physical or emotional abuse, extreme estrangement, abandonment, parental drug or alcohol abuse, mental incapacity or another such situation beyond your control. You can obtain a copy of the Dependency Status Appeal form from your Student Financial Services counselor.

For New York State Aid (Tuition Assistance Program – TAP)

A student who is below the age of 22, as of June 30th of the academic year they are applying, will be considered dependent on their parents unless they meet the special conditions for financial independence. As a dependent student you are required to provide your parents' income information.

To qualify as an independent student under the age of 22, the student must meet all of the basic conditions of eligibility PLUS one of five special conditions. Acceptable documentation must be submitted as proof to New York State Higher Education Services Corp. (HESC). If the documents submitted do not satisfy the special conditions requirements, the student will be denied for financial independence and must submit their parents' income information.

Students over the age of 35 are automatically processed as an independent regardless of how the financial independence questions are answered.

Special Conditions of Financial Independence

Condition: You are a ward of the court (not including status as an inmate).

Documentation: Copy of a court order making you a ward of the court or appointing a guardian other than your parents.

Condition: You are receiving public assistance under your own budget and not as a dependent of your parents.

Documentation: Budget statement or other documentation from a social service official showing receipt of public assistance other than food stamps, unemployment insurance, or Social Security benefits.**Housing Assistance/Budget Letter must be in students name.

Condition: There has been an involuntary dissolution of your family resulting in relinquishment of your parents' responsibility and control.

Documentation: A sworn and signed statement from a person other than yourself or your parents (such as a member of the clergy, a social worker, a legal aid representative, or an official at the facility or institution which has accepted responsibility for your control or care) relating to your family circumstances. The statement must include the specific reasons for relinquishment of parental responsibility and control (such as abandonment by the parents, mental and/or physical abuse by the parents, or parents being neither citizens nor residents of the United States), your relationship to the person making the statement, and how that person has direct knowledge of your family circumstances.

Condition: You are a veteran and have been honorably discharged from the U.S. armed forces.

Documentation: Copy of your DD214 showing an honorable discharge, or other official documentation from the Veterans' Administration or your branch of the service.

Condition: Parents are deceased, have been certified as having a total and permanent disability, or have been declared incompetent by judicial action.

Documentation: Copies of death certificates, medical certification, and court orders. NOTE: Documentation for both parents is required.

What is a Federal Stafford Loan?

The Federal Stafford Loan is loan guaranteed by the federal government. Interest rates are low and variable.

What is the difference between the Subsidized and Unsubsidized Federal Stafford Loan?

With the Federal Subsidized Stafford, the interest is paid by the government while you are in school. Conversely, the interest on the Unsubsidized Stafford Loan is accruing while you are in school and the student is responsible for the accrual upon the first disbursement of the loan. You have the option of paying the interest or deferring it until after you graduate, at which time it will be added to the principle of the loan.

What is EFT?

EFT or Electronic Funds Transfer, is used by lenders to transfer loan funds from lenders to schools without the use of paper checks. This method of disbursing loan funds shortens the length between receiving funds and the student having access to the funds. Therefore check with your private lenders to see if they use EFT with Hofstra.

What happens if I don't pay back my loan?

Not paying back your student loan can have serious consequences. If you go into default, your lender can require you to repay the entire amount immediately, including all interest plus collection and late payment charges. The lender can sue you and can ask the federal government for help in collecting from you. The Internal Revenue Service may withhold your income tax refund and apply it toward your loan. You cannot get any additional federal student aid until you make satisfactory arrangements to repay your loan. Also, the lender may notify credit bureaus of your default. This may affect your credit rating, which will make it difficult to obtain credit cards, car loans, home mortgages, etc., in the future.

It's likely I'll have to borrow every year to pay for my college expenses. How much should I borrow so that I know I can afford to pay it back?

Planning ahead is essential to managing debt. If you plan to borrow each year you are in school, estimate the total amount you will borrow. Then use a sample loan repayment table to calculate how much you will have to pay each month. Then decide how much to borrow. You can use the criteria lenders use when they consider an applicant's ability to repay: the total monthly payment for all debts should not exceed 8% of your gross monthly salary. For a sample calculator please click on the link.

If I borrow from more than one loan program, I may have to pay several different lenders at the same time.

May I consolidate my payments?

If you've borrowed from more than one type of loan program, you may be able to consolidate some of the loans and use one payment plan to repay the loans. In general, federal loans may be consolidated into one new loan at an interest rate of the weighted average of the original interest rates of the loans being consolidated. As mentioned you can consolidate Federal loans with other federal loans, and you can consolidate Alternative loans with alternative loans, but you can not consolidate Federal loans with Alternative loans. The length of the extension depends on the total amount of the loans consolidated.

What if I want to return a portion of my Direct loan?

You can send your request from your Hofstra email account to the Bursar. If your parent who borrowed a Direct Parent PLUS loan wants to return a portion of it, they can send an email to Bursar. (Don't forget to include your student ID number on all emails.)

Please keep in mind that student and parent requests to return federal Direct Loan funds will only be processed by the Office of Financial Aid within 120 days after the funds have been disbursed. No requests for returns will be processed after such time unless it falls within the 14 days of the disbursement.

The federal processor uses a system of edits, or flags, which produces a selection of certain applications for verification. If your application is selected for verification, this may mean that a data element in your application does not fit generally recognized patterns (not necessarily that the element is incorrect; it merely must be verified), or that your application was simply selected at random.

You will be required to submit a completed verification worksheet, copies of W-2 forms and copies of you and your parents federal tax return transcripts (if you did not use the IRS data transfer) if you are a dependent, or your spouse's if you are independent and are married. Our office will make any necessary corrections to your FAFSA and your award. In addition to those selected by the FAFSA processor, the college also has the option of selecting any additional FAFSA for verification.

What if you don't have copies of your federal tax transcript to submit?

The fastest way to obtain a federal tax transcript is to print one at www.IRS.gov/transcript. If you have issues printing a copy, call to request a copy to be mailed to you at 1-800-908-9946.

Do I have to have verification done before Hofstra will send me my financial aid award?

No, if you are selected for verification your award letter will indicate so and a verification worksheet will be included. Your federal aid will not credit to your account and your Direct Stafford Loan will not begin to be processed until the verification is satisfied.

What aid programs is verification require for?

All federal aid programs except for Unsubsidized Stafford and Parent PLUS and Graduate PLUS loans can be processed.

If I don't complete the verification, what will happen?

Your federal aid will not credit to your account and any Subsidized Stafford Loan will not begin to be processed until the verification is satisfied. All federal aid will be canceled except for Unsubsidized Stafford and Parent PLUS and Graduate PLUS loans.

My parents (or I or my spouse) have an extension to file federal income tax returns, what do I do?

Complete the verification worksheet (if requested) and submit a copy of the extension to us that has not expired along with any W-2 forms or 1099 forms they have. Complete a blank copy of a federal tax return and fill it out, write "estimated" on the top and sign it. Once the actual tax return is completed, a copy of the federal tax return transcript may be required to be submitted to financial aid. Awards may be adjusted based on the actual information.

If it is past the last day of school for the academic year is it too late to submit my verification?

No, we have up until 120 days after your last day of enrollment to process verification. However, it would be too late to certify Stafford Loans since they have to be certified by the last day of enrollment.